Financial and managerial accounting 7th edition – Welcome to the seventh edition of Financial and Managerial Accounting, the definitive guide to the principles and practices of financial and managerial accounting. This comprehensive resource provides a thorough understanding of the concepts, techniques, and applications of accounting in both financial and managerial contexts, empowering readers to make informed decisions that drive organizational success.

Throughout this edition, you will delve into the intricacies of financial accounting, exploring the processes involved in preparing financial statements and understanding the principles that govern their presentation. You will also gain insights into managerial accounting, uncovering its role in supporting decision-making, controlling costs, and evaluating performance.

Introduction to Financial and Managerial Accounting: Financial And Managerial Accounting 7th Edition

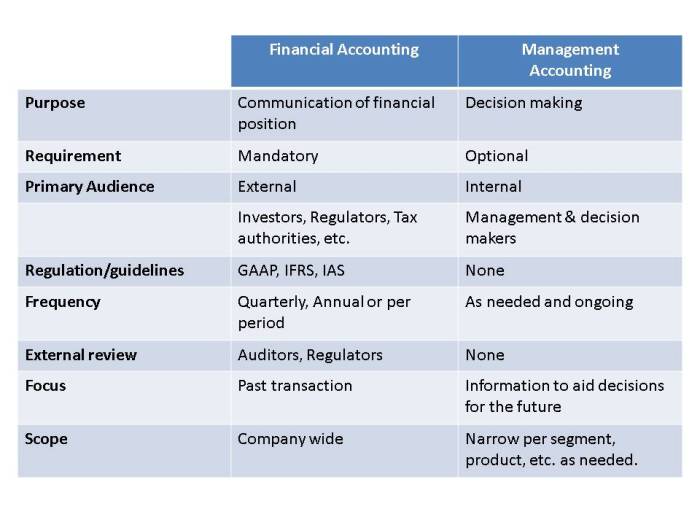

Financial and managerial accounting are two distinct but interrelated branches of accounting that serve different purposes within an organization.

Financial accounting focuses on providing information to external users, such as investors, creditors, and government agencies, while managerial accounting provides information to internal users, such as managers and employees, to assist them in decision-making and planning.

Both financial and managerial accounting rely on the same underlying principles and concepts, but they differ in their objectives, scope, and reporting requirements.

Financial Accounting, Financial and managerial accounting 7th edition

Financial accounting is governed by a set of rules and standards that ensure the accuracy and reliability of financial information. These rules and standards are established by accounting standard-setting bodies, such as the Financial Accounting Standards Board (FASB) in the United States.

The primary objective of financial accounting is to provide information about a company’s financial performance and position to external users. This information is used by investors to make investment decisions, by creditors to assess creditworthiness, and by government agencies to regulate businesses.

Managerial Accounting

Managerial accounting is not subject to the same rules and standards as financial accounting. Instead, it is tailored to the specific needs of an organization and its management team.

The primary objective of managerial accounting is to provide information to internal users to assist them in decision-making and planning. This information can be used to evaluate the performance of a company, to make budgeting decisions, and to develop strategies for improving profitability.

Key Questions Answered

What is the primary objective of financial accounting?

The primary objective of financial accounting is to provide information about an organization’s financial performance and position to external users such as investors, creditors, and regulatory agencies.

How does managerial accounting differ from financial accounting?

Managerial accounting focuses on providing information to internal users such as managers and employees to support decision-making, planning, and control within the organization.

What are the key principles of cost accounting?

Cost accounting involves identifying, classifying, and assigning costs to products, services, or activities to determine their profitability and efficiency.